The unbroken rise in prices and the continuing shortage of many plastics continue to put pressure on manufacturers of plastic packaging. A current fifth flash survey among the members of the IK Industrievereinigung Kunststoffverpackungen at the end of May shows how extremely tense the situation in the industry continues to be: according to the companies, the prices of many standard plastics have increased by more than 70% since the beginning of the year. In addition, transport and logistics costs have risen sharply. In addition, the shortage of important plastics continues to cause packaging manufacturers considerable problems in production.

The raw material bottlenecks continue to affect all plastics, although overall there are signs of a slight easing. 67% of the participating companies report a currently poor to very poor supply situation – a month ago the figure was just under 80%. As in the previous month, eight out of ten plastic packaging manufacturers had to cut their production due to the shortage of raw materials, one in five even to a considerable to very great extent.

Recyclates also affected by significant price increases

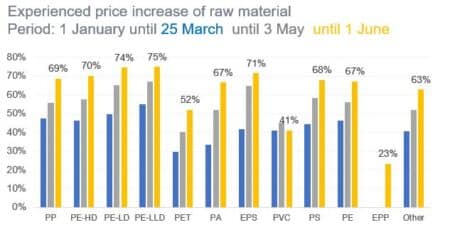

The highest price premiums were recorded by the end of May for LLDPE and LDPE with +75% and +74% respectively, followed by PP, HDPE, PE, PA, PS, PVC and EPS (each between +67% and +71%). In some cases, the mark-ups are significantly higher than these average values. Prices for recycled plastics also continue to rise: Since the beginning of the year, prices for recycled PP, LDPE and PS have risen by more than 50%. Recycled PET is on average 43% more expensive than five months ago.

“The situation in the industry is and remains extremely tense,” IK Managing Director Dr Martin Engelmann summarises the current situation. The historic high prices for many standard plastics have largely decoupled from the price development for petrochemical raw materials.

More transparency demanded in cases of “force majeure

Dr. Martin Engelmann, Managing Director IK

“The situation is additionally aggravated by the still very high number of force majeure cases of the plastics manufacturers”, says Engelmann. As before, two out of three packaging manufacturers are affected by one or more plant failures of their suppliers. Compared to the previous month, this number has even increased. He renews his demand for more transparency and points to an information letter for IK members on the legal requirements for a case of “force majeure”: “Only if the suppliers describe the reasons for the plant failure in a comprehensible and detailed manner can you expect understanding on the customer side,” says Engelmann.